A Utah electric vehicle dealer exposed how some dealers are gaming federal tax credit rules, angering viewers and exposing questionable practices in the used electric vehicle market.

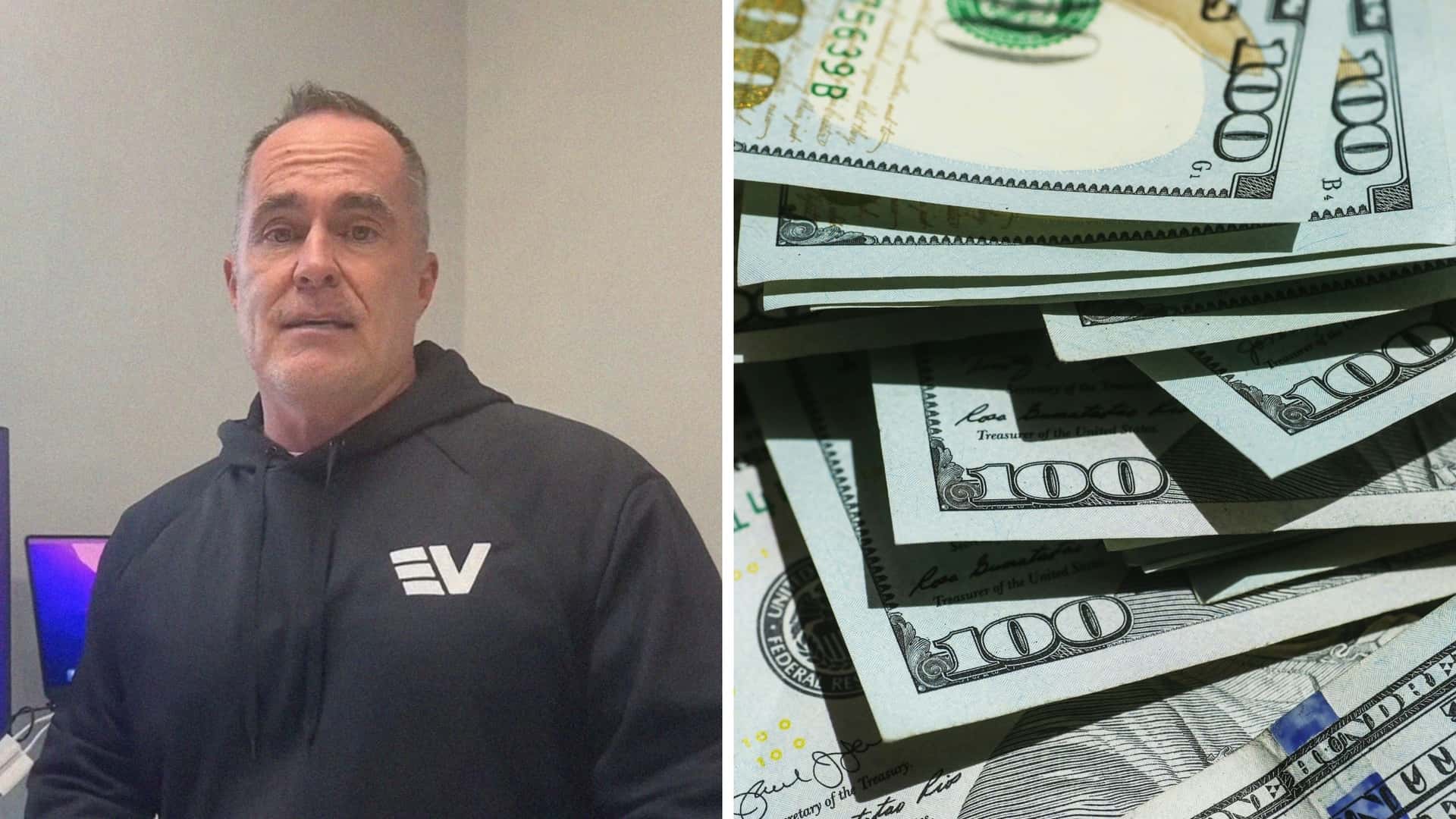

The 2-minute, 54-second video, which has had 979,000 views since June 11, shows Alex Lawrence (@evautoalex) sharing a phone conversation with a follower who encountered what appears to be an illegal scheme to circumvent Internal Revenue Service (IRS) regulations.

Lawrence, who runs EV company Auto Alex and has built a following of more than 163,000 subscribers by offering insider tips on financing and purchasing electric vehicles, recorded the conversation in his spare office inside his dealership in Utah. The video captures a live phone call with a TikTok follower who tried to buy a used Tesla Model 3 the day before from what he described as a “large dealer lot in Utah.”

The alleged scheme unfolds

The caller’s account includes a blatant attempt to get around federal tax credit requirements. According to the transcript, the customer visited the dealership specifically looking for a used Model 3 that qualified for the federal tax credit, meaning it had to be priced at $25,000 or less.

“Hey man, I’m looking for a used Model 3. Something that qualifies for a tax credit, $25,000 or less,” the caller told the salesperson. The dealer showed him a car that appeared to be worth $28,500.

When the customer questioned the price discrepancy, the salesperson allegedly revealed his workaround strategy. “So what we do to get around that is we charge you 24.5 (thousand) paper bills for the Tesla. Then we charge you $4,000 for the charger,” the caller recounted.

Until it expired on September 30. Federal tax credit For used electric vehicles, up to $4,000 is provided for eligible vehicles, if the total purchase price excluding taxes and registration fees is less than $25,000.

By artificially separating fees and listing mandatory add-ons as separate items, the agency is allegedly trying to make an ineligible vehicle appear compliant with IRS requirements.

according to IRS guidance For an expired credit, the sales price includes all dealer-imposed costs or fees that are not required by law, specifically including “the retail price of each accessory or item of optional equipment actually attached to the vehicle at the time of sale.” The IRS explicitly states that dealers cannot reduce the selling price of a clean used vehicle based on mandatory add-ons, as “the amount of the reduction will be considered part of the selling price for credit purposes.”

The client responds with evidence

The customer was not convinced by the seller’s assurances. Armed with knowledge from Lawrence’s previous instructional videos, he challenged the agency.

“I just saw a video that referenced your video that said it was used as a gray area, but it was made clear that the total purchase price, excluding tax and registration, had to be less than $25,000,” the customer told dealership staff.

The CFO was called in to deal with the situation, but he continued to insist that their method was legitimate. When the client showed them Lawrence’s TikTok explaining the regulations, the CFO allegedly “tried to ignore it,” saying “Nah man, that’s totally fine. We’ve done this a few times. It’s all good.”

Lawrence was tickled by this turn of events. “Are you serious? You showed the CFO a video of me?” he asked, adding, “That’s great.”

Escalating pressure tactics

When the client requested written assurances that the agency would cover the $4,000 if the tax credit was denied, the CFO refused. According to the caller, the agent then tried a more questionable approach.

“Finally, he said, ‘Listen, man, we’re going to sell you this now,'” the customer recounted. Tax, title deed, outside door, 24.5 (thousands). Then you have to come tomorrow and pay us $2,000 in tips.”

Lawrence immediately realized the legal implications. He replied: “He wanted to make a separate transaction. Two large amounts. My friend, this is very illegal.”

If the client did this, it would likely constitute tax fraud. The IRS has clear authority to pursue such arrangements e.g Abusive tax evasion transactionswhich includes “sham arrangements that have no economic significance or commercial purpose other than to avoid or evade taxes.”

Understand tax credit requirements

the Federal Tax Credit for Used Electric Vehicleswhich was formally known as the Ex-Owned Clean Vehicle Credit, had specific eligibility requirements designed to help low-income buyers access electric vehicles. To qualify, a car needs:

- Purchased from a licensed dealer

- The cost is no more than $25,000

- He must be at least two years old

- Meet the buyer’s income requirements

The IRS has been clear that the $25,000 cap applies to the total purchase price excluding taxes, title, and recording fees only. IRS Documents Specify that the sales price “includes all dealer-imposed costs or fees that are not required by law” and expressly includes “dealer documentation fees, which are part of the cost of purchasing a vehicle and are not required by federal or state law.”

Dealer-mandatory add-ons, accessories and extended warranties must also be included in the purchase price calculation.

The electric vehicle incentive was ended after the One Big Beautiful Bill Act, passed on July 4, was repealed.

Community response and industry recognition

The video sparked hundreds of comments from viewers, many of whom shared similar experiences at dealerships across the country. Several commentators specifically mentioned agent groups by name, suggesting that this practice may be more widespread than initially apparent.

User Dylan Eriksen commented that the local dealership group was “doing what they do best 10/10 not recommended.”

Another commenter, asell87, shared his own experience with what appears to be the same group of agents: “I left a 1-star review after my experience. They called me and sent me a check for $100 to remove the review. They’re lazy.”

When Lawrence asked for more information, asell87 explained, “They contacted me after I left the review and said what do you think about us sending you $100 for the frame issues and asking you to remove that review. I received $100 for the frame, but I kept the review up because they definitely deserve it and want to warn others.”

Engine1 I reached out to the alleged agent via email for comment. We will update this if he responds.

The customer buys his electric car elsewhere

Despite the frustrating experience, the story had a happy ending. Lawrence offered the customer “$1,000 off any car I own” because he is “a good guy and does the right thing.” The customer accepted the offer, and Lawrence confirmed in the comments that he “came and bought” a car from EV Auto Alex.

The video also served an educational purpose, with many industry professionals commenting that they learned from Lawrence’s content. User brianatbutler wrote, “I just got my agency to approve this because of your videos! My manager had no idea about this. So thank you!!”

Agency workers weigh in

The video caught the attention of agency employees who wanted to ensure their stores did not engage in similar practices. Haley commented, “I work for a large agency in northern Utah and I listen to these videos for clues to make sure they are not affiliated with us. I have not encountered any (agents) doing this yet!”

Lawrence responded that he was not “aware of anyone in Davis County and the north doing this,” suggesting that the practice may be concentrated in certain areas or certain merchant groups.

Wider implications

Lawrence’s video highlights the importance of consumer education in navigating complex federal stimulus programs. His approach – which combines entertainment with practical advice – has clearly resonated with electric vehicle buyers who need reliable information in a rapidly evolving market.

The incident also illustrates how social media can serve as a check on questionable business practices. The client’s decision to display Lawrence’s educational content to dealership staff shows how informed consumers can fend off potential fraudulent schemes.

Lawrence noted in the comments that he was aware of “three” agents engaging in similar practices and was “trying to reach out to the owners directly man-to-man first” before taking further action, suggesting he is taking a measured approach to addressing the issue.

Engine1 I reached out to EV Auto Alex via email for additional comment. We’ll be sure to update this if they respond.